¿Cuánto tiempo debe conservar las multas pagadas?

Paid paid? The best thing you can do is not throw it away immediately. Here is how long you should keep the document.

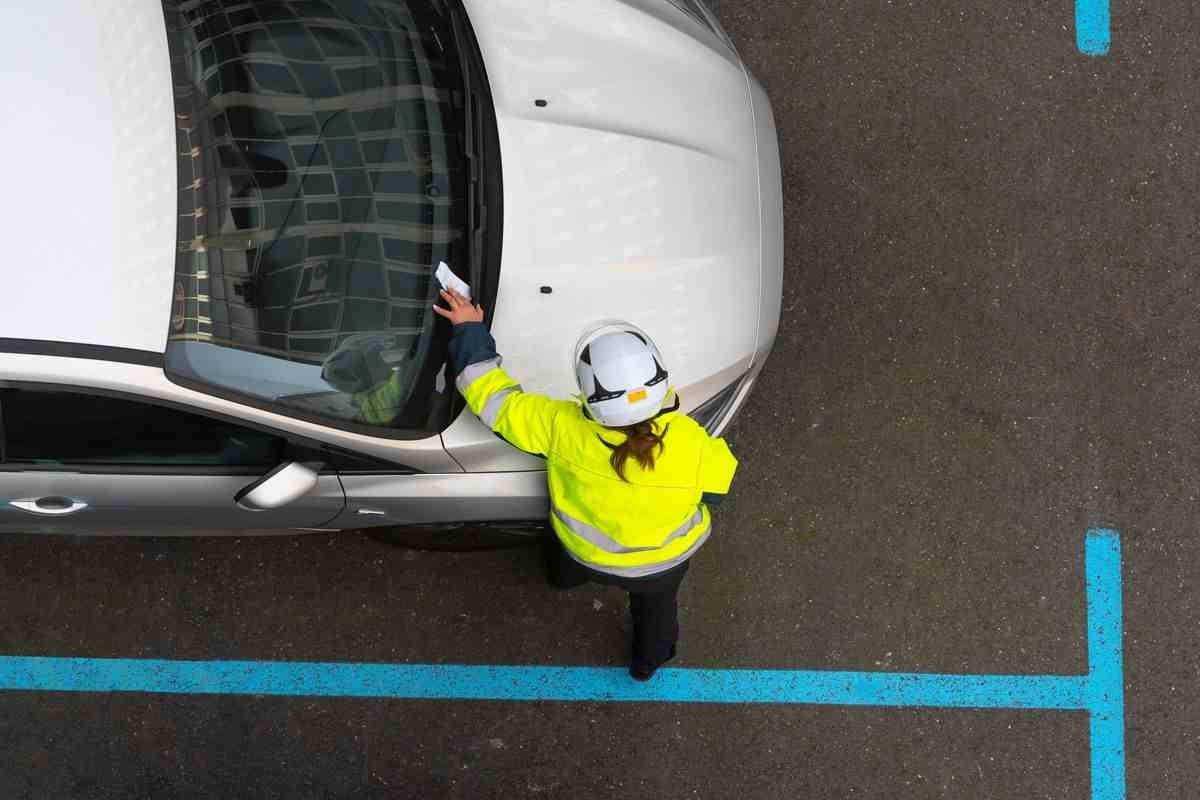

The worst moment, for a citizen, who drives a car or takes any other action contrary to what the law decided, is the payment of a fine. However, after this has happened, we can say that the worst is over.

You can resume living daily life, discard the paid fines receipts, and try to recover the money that has been lost without committing any wrongdoing. Or maybe, right? Apparently, maybe The best thing to do is Not throw them away immediately.

In this article, we will find out How long should they be kept? The «proof» of our payment. This applies not only to fines but also to invoices and taxes, so there is very important information for those who respect the law and might give up too easily and too soon the receipt that notifies the payment on which the payment was made.

Do not discard the receipts of paid fines immediately: until you keep them

The first thing to say is that payment receipts Must be kept to avoid the risk of not being able to prove the payment was made, so it is definitely very useful to know Payment terms of credit, which are established by law and vary depending on the type of document. Also, in addition to the expiration to consider, it is always best to keep the documents One or two years compared to the provisions of the law (it may happen that the conditions of revenge by the agencies for payment request have been extended for several months). For Contravention management, conservation should be At least five years. For TV subscriptions, five years is the term (but a court ruling in Turin has extended it to ten).

For rental, monthly or quarterly payments should be kept Five years. For insurance, it is only one year. Generally, in terms of the most classic Water, electricity, gas, or telephone bills, the term is Five years from the payment date. In the latter case, it is also a good idea to keep the bank statements from the bank where the payment is certified each time. For Stamp duty, it is best to keep the payment document Up to 4 years. There are also documents that are best kept, always keeping them. We are talking about school diplomas, employment contracts, certifications or resignations, salaries, and more.

![Cómo usar un gato de forma segura y fácil[embed]https://www.youtube.com/watch?v=sdilq-1trta[/embed]](https://nuevaprensa.info/wp-content/uploads/2025/04/Como-usar-un-gato-de-forma-segura-y-facilembedhttpswwwyoutubecomwatchvsdilq-1trtaembed-800x450.jpg)

![¿Es posible instalar un sistema GLP en una máquina diesel?[embed]https://www.youtube.com/watch?v=26scslycbpe[/embed]](https://nuevaprensa.info/wp-content/uploads/2025/04/¿Es-posible-instalar-un-sistema-GLP-en-una-maquina-dieselembedhttpswwwyoutubecomwatchv26scslycbpeembed-800x450.jpg)